Balance Sheet Thinking

Imagine your financial world in one place, organized and future-ready.

Our advanced, Balance Sheet thinking strategies address:

- How to view your personal balance sheet: net worth, protection, cash flow

- How business value affects your financial future and net worth

- How to avoid neglecting balance sheet thinking in your personal finances

- How Balance Sheet thinking helps create the opportunity to live a good life for the rest of your life

Show more

ARTICLE

Personal Balance Sheet

Balance sheets aren’t just for business. Imagine a Balance Sheet for your personal strategies. Our Personal Balance Sheet system automatically updates and tracks the value of your assets in more than 6,000 savings, investments, retirement, and real estate accounts along with the balances of any loans from credit cards, car or student loans, mortgages, and even the taxes owed in most 401(k) accounts. And perhaps most importantly, it tracks and calculates your net worth, the sum total of what you can truly count for big life financial objectives, like education, savings and retirement.

BROCHURE

Path Of Confidence®

At the end of the day, each of us is doing our best to live a good life. While money is no assurance of a good life, not having enough money can certainly threaten it. At Pacific Advisors, we take decades of collective knowledge, coupled with time-tested approaches, to help you and your family craft a plan of action for financially producing and supporting a good life for the rest of your life. We call this plan your Path of Confidence®.

COMPLIMENTARY OVERVIEW

Personal Balance Sheet 30-Minute Tour

A financial strategy expert will demonstrate The Living Balance Sheet and help you consider how it can be personalized and become a powerful financial organizational capability.

COMPLIMENTARY OVERVIEW

Path of Confidence® 30-Minute Tour

Implementing a plan for lifelong financial success takes time. Our financial specialists help you establish a plan that works within your current resources to develop initial action steps, while creating a sequence of future action steps that guide you toward your ultimate financial objectives.

If you’d like to audition the Path of Confidence for you and your family we offer a complimentary personalized tour to see if it’s a fit.

NEW DISTINCTIONS FOR FINANCIAL BALANCE™

Our goal is to improve your ability to offset volatility in challenging financial times and for you to have a plan to meet your goals going forward. Our strategies allow you to counter financial threats by leveraging:

- Diversification and balance between Market-Based® and Promise-Based® Assets

- Tax efficiencies through asset allocation and asset location

Show more

ONE-SHEET

Market Based Assests Versus Promise Based Assets

As you look at building your financial plan, you may want to audition a balance between market based and promise based assets. Download this resource to discover the different risks and purposes of each, and where they might make sense in your strategy.

BROCHURE

Tax Diversification Strategy for Optimizing Retirement Income

Our mission is help you keep more of what you earn and protect what you've worked so hard to build.

The tax code, along with federal and state law, create countless opportunities for growing your future retirement investments in a tax advantaged way. Because some of these rules can appear complicated, many of the opportunities for Tax Diversification of account types may go unrealized.

Our Annual Insights team specializes in assessing your current situation, identifying opportunities and proposing strategies to optimize your position. We work with your trusted accounting tax advisors to generate additional financial tax efficiencies.

PRESENTATION

Tax Diversification Strategies

Receive the slide content utilized in the above Tax Diversification Strategies video.

COMPLIMENTARY OVERVIEW

Personal Investment Analysis

Are you taking more risk than necessary to achieve your desired returns?

Our approach goes well beyond traditional assets found on exchanges such as NASDAQ and the NYSE to include asset classes such as your own business, real estate, and capital equipment/inventory. Our broader approach takes into account unconsidered, actual risk business owners take in their full asset portfolio which may directly contradict their risk profile and thwart their objectives.

Whether you'd rather pursue higher returns for similar risk, or similar returns for less risk, Coordinated Asset Strategies to help achieve your goals are a specialty of Annual Insights.

COMPLIMENTARY OVERVIEW

Tax Diversification 30-Minute Tour

Receive a 30 minute consultation that goes beyond traditional portfolio analysis, which often only explores the types of vehicles in which you are invested. We recommend taking a closer look at the tax efficiencies that may be available through asset allocation, as well as tax diversification advantages through Asset Allocation.

Preparing for the Unexpected

If 2020 taught the World anything, it was to expect the unexpected.

Are you protected against your greatest financial threats?

Whenever we don’t plan for the unexpected we are financially "on the hook" to shoulder the burden ourselves. However, for a potentially small percentage of your income we can help transfer the financial burden by insuring it or planning for it.

- Death

- Sickness

- Disability

- Liability

- Asset Protection

- Loss of work

- Damage to property and vehicles

- Estate planning

How are you planning for the unexpected?

Have you taken care of these concerns to your satisfaction?

What happens to your family or loved ones if something happens to you?

Show more

CHECKLIST

Protection Checklist

With this protection checklist, you can look at the considerations across a wide array of protection concerns. Use this checklist to explore areas you may have neglected or need to update.

WORKSHEET

Appropriate Amounts of Life Insurance

With this easy to use worksheet, you can gain an understanding of how much financial protection to consider. The first protection priority of life insurance is to produce everything you are financially committed to in your life should you not be there to produce it. We’ll help you take into account your priorities and protect those you love if you weren’t there to fulfill those same priorities.

And if you are a business owner, this worksheet also takes into consideration the value of your business and transferring its value to your survivors.

ONE-SHEET

Bridging the Gap (Disability)

Did you know that 1 in 4 of today's 20-year-olds can expect to be out of work for at least a year due to a disabling condition before they reach the normal age of retirement? Would your company's long-term disability plan provide for your current lifestyle? With this one-sheet, you can see how individual disability and group long-term disability can you help you bridge the gap if something happened to you.

COMPLIMENTARY OVERVIEW

Protection Assessment 30-Minute Tour

Recent times have taught us to prepare for the unexpected. In just 30-45 minutes, you can have a financial professional take a closer look at your financial world and be able to make recommendations for things you may want to consider, at no further obligation to you.

5 Major Financial Interruptions

Are you protected against the 5 Major Interruptions to Income?

What happens if you, or someone you count on:

- Becomes sick or disabled?

- Dies?

- Faces legal liability?

- Becomes unemployed?

- Retires?

It’s important to have a financial strategy to prepare for many of these inevitable outcomes. This can help assure that you and those you love can continue to lead a good life for the rest of your lives.

Show more

Scorecard

Personal Concerns Assessment

LIfe and finances give us more to worry about that we can handle all at once, which is why we like to help people “Worry in Order.” By selecting a few key priorities we can help people advance their financial objectives over time. Use this worksheet to identify your top concerns to create priorities with a financial professional in”Worry in Order.”

COMPLIMENTARY OVERVIEW

Personal Balance Sheet 30-Minute Tour

A financial professional will demonstrate our personal balance sheet software and how it can help you get financially organized and take control.

COMPLIMENTARY ON-DEMAND WEBINAR

Uncommon Insights for Creating Financial Priorities

With so much to handle in our financial lives, figuring out where to begin can be a struggle.

With more than 60,000 clients we'll bring you the best of what we've learned in the 5 financial priorities everyone should audition. We'll share the ways we've found helpful to sequence these priorities and why, as well as actionable next steps for finally taking control of your financial future.

We've squeezed a lot of insights into an easy to understand 25-minute webinar - view the webinar now!

Watch it HERE

Avoid Single Points of Failure in Your Business

Did your business come with an instruction manual telling you how to avoid single points of failure?

Probably not. We can offer the following:

- Get your financial world in one place

- Help ensure your business’ best chance of survival if the unthinkable happened to you

- Create Business Continuity Instructions for anyone taking over your business

Show more

SAMPLE INSTRUCTION BOOK

Business Continuity

Do your family and business partners know what to do if something happens to you? Who has the keys to your business? Who knows how to keep things running in your absence? Your business didn't come with an instruction book, but our Business Continuity Instruction Book will help you be more prepared.

COMPLIMENTARY OVERVIEW

Continuation Insights Tour

In this exploratory discussion, we'll review insights and risks to consider in Customer, Human, Management, and Financial Capital. Schedule your overview to discover how we help you manage the points of risk that most impact transferrable value and ensure your business continues successfully through planned and unplanned events.

Strategies that Motivate Your Most Valuable Asset - Your People

Your company's census is more than just a listing of who works for your company. It is a way to powerfully build a plan to attract, retain and reward the valued employees of your company, as well as, provide vehicles for retirement for you and your people. Whether you are focused on how to provide benefits at a lower cost, provide unique benefits for competitive advantage, or how to reshape your retirement plan so that you as an owner can get more into it...Census can be a competitive set of strategies to accomplish all of these.

Show more

Presentation

Strategies for How to Attract, Retain, and Reward Your People

Receive select portions of the presentation we utilize when discussing Census Insights with business owners. This presentation calls out factors to consider with Group Benefits, Supplemental Benefits, Voluntary Benefits, Multi-Life, Carve-Out, Top-Hat Plans, Qualified Plans, Education/Wellness Programs, and how they tie to Performance Insights.

One-Sheet

Advanced Strategies for Your Key Executives

Every company competes for talented key executives. Qualified plans can help retain executives, but can incur higher costs and regulations. This one-sheet takes a hypothetical walk-through of a low-cost, less regulated Non-Qualified 409A plan and outlines the benefits for employers and key employees.

Download the one-sheet and schedule a tour (at right) for a complementary walkthrough of Advanced Strategies for Your Key Executives.

Complimentary Overview

30-Minute Tour

Receive a 30 minute overview of Census Insights strategies to help business leaders compete efficiently to attract, reward, retain, and retire valued employees, executives, and owners.

Complimentary Overview

Advanced Strategies for Your Key Executives

Schedule a tour and download the accompanying one-sheet - Advanced Strategies for Your Key Executives.

Helping Businesses Earn More and Keep More

Do you understand, measure, and manage your company by the 7 fundamental cash drivers?

Arm yourself to aim at what financially matters most in your company. You are counting on your business for your financial future, but do you know the cash drivers that directly impact profits and enterprise value? Few owners or executives have the tools or make the time to manage the key cash drivers that directly impact their profitability and enterprise value.

With basic financial information found on your balance sheets and P&L statements, you can bring key insights to improve your company's performance.

Performance Insights provides a series of key business metrics, with actionable strategies to begin affecting the enterprise immediately.

Show more

BROCHURE

7 Cash Drivers

There are 7 Cash Drivers that impact your Income Statement and Balance Sheet. They impact your margins, cash cycle, and asset utilization. In this brochure, get a bird’s eye view of the 7 Fundamental Cash Drivers and Where to Find Them.

One-Sheet

Maximizing Your Enterprise Value

Looking to Maximize Your Enterprise Value or the Sale of Your Business? Take a closer look at the strategic phases of the business life cycle and the sale event of your business. We help you examine the timing and details of what may need to happen from all along your business lifecycle to approaching, during, and after the sale.

Scorecard

Financial Priorities Self-Assessment

Life gives us more to worry about that we can handle all at once. This self-assessment can help you “worry in order.” By completing this short assessment you will be able to quickly identify your top priorities and for any 4’s or 5’ you rate yourself, you may want to speak with a financial professional.

COMPLIMENTARY OVERVIEW

7 Cash Drivers Performance Check-Up Report

Looking to understand how key cash drivers can impact your company’s performance this year, next year, and beyond?

It’s our experience that most business leaders are surprised to learn how much information is available from a thorough analysis of their corporate tax and financial statements. Performance Insights provides a series of key business metrics, with actionable strategies to begin affecting the enterprise immediately.

COMPLIMENTARY OVERVIEW

Annual Insights Program

Annual Insights provide comprehensive financial strategies to help you Adapt, Get Ahead, and Thrive with life's ever-changing financial situations. Whether you are an experienced professional, executive, or business owner, Annual Insights will help you be perpetually "future ready." Schedule a 30 minute, complementary consultation to determine if Annual Insights is right for you.

Valuations that Drive Financial Performance

Many have come to think of a business valuation as merely a resulting number for the value of their business.

While that can be true, what many miss is the opportunity to use the valuation to reveal all the actions they can take today to significantly impact their financial performance, and begin affecting the enterprise immediately.

- Check your progress towards your ultimate financial objectives,

- Create agreement with fellow business partners in advance of a crisis,

- Position the company for the lowest costs of capital.

Making a practice of running an enterprise valuation each year keeps your business in a ready state for the best offers and opportunities that come your way.

Show more

PAPER

Enterprise Valuation

Typically, business valuations are considered useful only for one-time purposes such as a purchase or sale, a financing requirement, estate planning, divorce proceedings, tax assessments, or a liquidation event. While those are situations that require a valuation, this thinking misses the ongoing benefits of an annual valuation as a practice.

Few have considered the effectiveness of utilizing annual valuations as a way to check your progress towards your ultimate financial objectives, to create agreement with fellow business partners in advance of a crisis, and to position the company for the lowest costs of capital.

Making a practice of running an enterprise valuation each year keeps your business in a ready state for the best offers and opportunities that come your way.

FACT SHEET

Performance Valuation

Contrast different valuation methodologies and purposes to see what makes a Performance Valuation a great choice.

SAMPLE REPORT

Sample Valuation Report

Receive a sample valuation report that illustrates the depth and breadth of analysis we take with our clients.

COMPLIMENTARY OVERVIEW

Personalized Overview of Performance Valuation

We will show you the 6 widely accepted valuation methodologies we employ, the 4 tiers of Valuation Reporting, and performance indicators that drive a performance. Ask questions and audition whether or not it could be a fit for you.

The 4 Interruptions to All Partnerships

One thing all business partnerships have in common is...they all end.

Fundamentally, there are four interruptions to partnerships:

- Illness or Disability

- Untimely Death

- Involuntary Departure

- Voluntary Departure/Retirement

Are you confident your operating agreement handles all four of these interruptions to your satisfaction?

Show more

BROCHURE

Annual Insights Overview Brochure

COMPLEX OUTCOMES REQUIRE ADVANCED STRATEGIES

With decades of collective experience, our Annual Insights team offers many strategies that can be tailored to fit your complex financial concerns and objectives. Given the wide availability of financial products in the marketplace, we are often asked how our strategies are distinct. This brochure introduces the specialized types of financial efficiency, optimization, and protection strategies we advance for our clients. Perhaps just as important, it also demonstrates how comprehensive and coordinated our team is on behalf of complex client concerns.

QUESTIONNAIRE

Operating Agreement Review Questionnaire

Download a complimentary buy/sell agreement review questionnaire.

COMPLIMENTARY OVERVIEW

Operating Agreement Review

Let our team demonstrate our value by providing you with a complimentary operating agreement review. We'll provide a summary report alongside insights and recommendations regarding places where your agreement might not perform as expected.

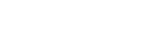

Annual

InsightsTM

Program

Bringing together personal and business insights to craft financial efficiencies and optimization.

We Take Comprehensive To A New Level

Annual Insights are designed to be part of your cross-functional team with a view on your entire financial picture.

Strategy

versusAdvice

Many clients ask us about the difference between providing insights, sharing strategies, and offering advice.

By providing insights, we disclose observations about the gaps and opportunities our specialists notice in your financial situation. Our analysis may point out places where your current strategies meet or fail to fit your objectives.

When sharing strategies, we introduce often overlooked methods and approaches for improving your financial position. We present relevant plans of action and discuss how and when they can be used effectively.

When offering advice, we make specific recommendations based on your particular situation, objectives, and risk tolerances.

Our Annual Insights Team can offer big-picture insights and strategies across personal, family, or business planning concerns. In nearly all cases, professional advice is regulated and necessarily limited to those with the appropriate professional licenses (legal, accounting, investment, insurance, etc.). As a financial services firm, we are able to offer specific advice in financial planning, investments, and risk management, yet we work collaboratively with other licensed financial professionals, such as tax and legal advisors.